A-Share: Is It Time to Board as the Market Retreats?

- 2024-08-10

- News

- 41

- 15

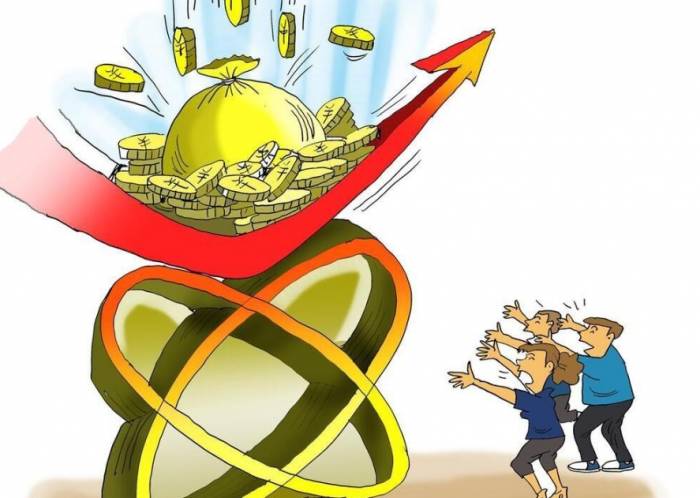

This morning's A-share market exhibited divergence, with the broad market index showing weak performance, which directly dragged down the performance of other indices. This made today's market trend appear confusing. The trading tactics of the main players in the A-share market have returned to the pattern seen after last year's Spring Festival, still following the same old playbook with no novelty. Why is this the case? Can the A-share market recover in the afternoon? I will share a few points for everyone to discuss.

Firstly, the divergence in today's A-share market.

The broad market index was weak, while small and medium-sized stocks showed better gains, but this was also the trend for some specific sectors among small and medium-sized stocks. The A-share broad market opened lower today, and to fill the gap in the early morning, the main players used three rounds of upward pushes, closing the gap at 10:30 AM, thus avoiding the embarrassing situation of the 60-minute trend closing negative in the first hour. This is trading, the operation of main funds. Why do they do this?

Advertisement

The answer is to lure more buyers. In just one hour, there were three upward pushes, which无疑是 a temptation for some funds eager to enter the market. However, from the perspective of the market trend, not many funds entered.

The performance of large-cap stocks in the A-share market this morning was weak, almost all in adjustment. The oil index fell by 2.4%, with the largest drop among large-cap stocks. The social security heavy stock index fell by nearly 1%, baijiu fell by 1.19%, and sectors such as coal and banking were all declining. The securities sector showed a clear adjustment, but there were funds continuously manipulating the index to affect the trend of the A-share broad market.

The artificial intelligence concept, Star Flash concept, and other new technology stocks in the A-share market performed well this morning, building on yesterday's sharp rise and pushing higher again. The artificial intelligence index rose by 1.69%, with transactions exceeding 200 billion yuan. Looking at the average stock price trend in the A-share market, the number of rising and falling stocks in the morning was almost a fifty-fifty situation. However, as the index corrected, the number of falling stocks increased rapidly. This indicates that, apart from some popular stocks in certain sectors, the market is following the trend, with gains not being significant. After a wave of declines after 11 AM, the broad market index did not fall much, but the number of falling stocks quickly increased from more than 2,500 to more than 3,100, showing a weak general decline pattern.

Secondly, the A-share market has returned to the trend before last year's Spring Festival, before May, playing the old routine again.

Firstly, on January 30th after last year's Spring Festival, the trend was the same as on October 8th this year, with the same foreign capital buying spree, and the Northbound buying over a hundred billion and other hype being hotly discussed. The call for a bull market was flying all over the Spring Festival period, all using the holiday to heat up the market, making some retail investors impatient. After the festival, the A-share broad market opened with a gap higher, then pushed higher and fell back.The trend after this year's National Day is significantly different from that of January 30th last year, primarily in terms of scale and the more organized way that main funds are trading against each other, yet the outcome remains the same.

Secondly, after January 30th last year, there was a significant outflow of Northbound capital. The main forces within the market sought out various concepts, among which the "China" stocks with H-shares, China Special Valuation (CS Valuation), artificial intelligence concepts, and information technology innovation (Xin Chuang) originated from that period.

Apart from the artificial intelligence concept, these new themes essentially involved the disassembly and refinement of stocks heavily held by social security and insurance funds into new concepts. On one hand, they could align with the fluctuations of the Hang Seng Index, and on the other hand, they attracted people to take positions in A-shares. This is one aspect.

Most importantly, when the A-share market index declines, the market's main forces will speculate on the artificial intelligence concept to hedge against large-cap stocks, creating a lively scene to cover the escape of large-cap stocks. Today's A-shares have once again demonstrated this scenario.

However, we cannot ignore that the artificial intelligence concept in A-shares has not yet formed a leading stock, which is the real Achilles' heel of this sector and the fundamental reason why the artificial intelligence concept cannot replace the leading position of the securities sector.

This also indicates that the current A-share sectors lack new leading sectors. Relying solely on the securities sector is like a donkey that needs rest and food; it cannot keep turning the mill with its eyes covered. It can only be one sector's rise to cover the large-cap stocks' distribution. Otherwise, what can be done?

Without new leading sectors, how can there be a bull market? Everyone has seen significant increases and is thinking about finding someone to take over their positions. Who still cares about the rise and fall of the A-share market index? If you can run, take the opportunity to do so while it's above 3000 points.

The current trend of A-shares is strikingly similar to the trend after last year's Spring Festival, which is what worries me the most. This method of trapping people, which occurs periodically, will ensnare many new retail investors, which is also heartbreaking.

Thirdly, regarding the afternoon trend of A-shares, I maintain yesterday's judgment that it will be a slight decline after a brief rise.The 60-minute trend rebound has come to an end, with trading volume failing to expand. The primary driver has been manipulation in the securities sector, without any new leading sectors to take over. Today's A-share market saw a rise led by artificial intelligence concepts representing new technology stocks, but the overall effect was not good.

Let me reiterate my sincere advice: The A-share market is about to enter a phase of horizontal consolidation. As retail investors, we can ignore the large-cap stocks and focus on the stocks we hold. Sell high and buy low, making short-term trades during this period of fluctuation. Regardless of whether it's a bull market, bear market, or even a "pig market," mastering the rhythm is key.

Leave a Comment